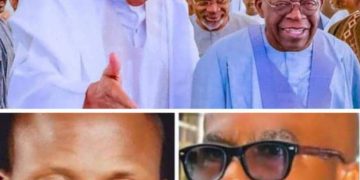

Two prominent finance and economic experts, Dr Paul Alaje and Mr Ugo Onuoha have formed a consensus that the present comatose state of Nigeria’s economy and the harrowing living conditions of overwhelming majority of the populace have their roots in wrong-headed economic policies introduced at the inception of the Tinubu Administration.

In the viewpoints of the experts, expectations banked on the humongous amounts to be generated into government coffers via the newly introduced Tax Reforms Law cannot on its own bail out the country’s economy from the doldrums unless there is a quick reversal of the current level of profligate spendings.

In effect, both Dr Paul Alaje and Mr Ugo Onuoha asserted that Nigerians fared better under the Muhammadu Buhari Administration in terms of the quality of living and purchasing power of the money at their disposal.

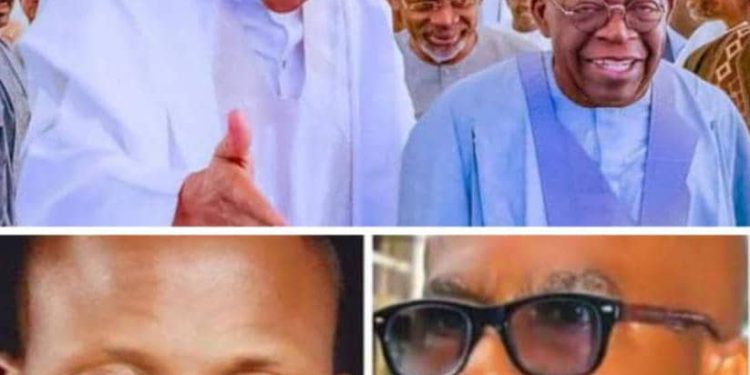

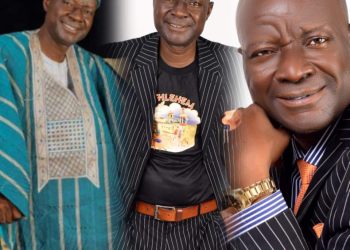

The two experts spoke while featuring as Guests/Discussants on the popular monthly interview discourse, Boiling Point Arena, hosted by a media professional and public relations strategist, Dr Ayo Arowojolu.

The current affairs programme was transmitted via Zoom and broadcast live on six radio stations across Lagos, Ogun and Delta States – WASH FM, Sweet FM, Roots FM, Eri-Nbe FM, Women Radio FM and Kruzz FM as well as a cable Television, NSTV on GoTV channel.

Topic of discourse for the 33rd edition was: “The New Tax Regime: Can Taxation Drive Development? What’s in it and What’s not in it for Nigerians?”

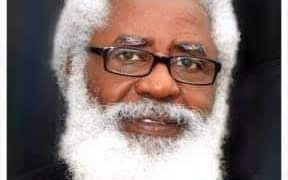

The event was chaired by a communication scholar and traditional ruler, the Olota of Ọta land, Oba Prof Adeyemi Obalanlege.

Dr Paul Alaje is the Chief Economist at SPM Professionals while Ugo Onuoha, a development expert, was former Managing Director/Editor-in-chief of Champion Newspapers Ltd.

The duo gave a scary forecast that if care is not taken, any hope of an early economic rebounce for Nigeria might take the next 10 to 15 years if the government does not jettison profligate spendings and revert to a low profile mode that will focus more on capital expenditures to benefit the populace.

Hear Dr Alaje: “What has happened to our economy is that Nigeria entered into the trap laid down by our colonialists and their international financial institutions. Apart from the not well thought out subsidy removal, the government went through the devaluation route, the same route taken in 1986 by former President Ibrahim Babangida. What changed in our economy? Nothing but a suicidal route.

“More than 50 per cent of African countries have all devalued their currencies. Now, show me anyone of them that has developed as a result of currency devaluation. What has changed in their economy?

“What must come with devaluation is aggressive capital development but what we are seeing is that the government is doing opposite of it in concentrating on recurrent spendings.

“Were Nigerians not to have introduced the subsidy removal and currency floatation policies, Nigerians would have fared better than if these policies do not come to operation. There is poverty everywhere. But we can no longer be crying over spilt milk.

“Nigerians should forget what happened before 2023 when Tinubu took over. We should now be looking at 2023 till date. So, if I am comparing from 2023 till date, I will tell you the economy of Nigeria has gone. But once I move outside 2023 to 2022, then of course you know that the economy then was far better than what you see today.”

On the tax reforms policies, Alaje nonetheless, commended President Tinubu for the far-reaching initiatives but cautioned that any attempt to increase the Value Added Tax(VAT) or increase any form of tax to nigerians in the immediate term, will be counter-productive and lead to hyperinflation.

For his part, Ugo Onuoha was of the view that government should concentrate more efforts in reflating the economy by putting more money in the hands of individuals and corporations rather than the governments at all levels cornering all the commonwealth meant for the people.

Onuoha said: “It is already clear to even the blind that at the outset of this Administration, the government made policies that were wrong-headed. The removal of fuel subsidy wasn’t well thought out. Safety nets were not provided, And that was the Achilles’ Hill. The issue of palliatives were just an afterthought and have been insignificant, no connect with the people absolutely.

.

“I am not in a hurry to be absolute about anything, but I am minded to align with Dr Paul Alaje that the policy decisions and implementations cannot be completely reversed. To reverse them would mean, for instance, going back to a litre of petrol at a price of N200 at the pump head or an exchange rate of between N400 and N500 at $1. I don’t see it happening.

“For me, concerning the tax reforms, 4% levy on the profits of businesses should be scrapped. Our Government at all levels have not demonstrated capacity for prudent management of our commonwealth. VAT should remain as it is for the next five years at least while tax on capital gains is expected to increase for some people from 10% to 30% from January 2026 should be suspended.

“With about 161 million Nigerians or about 75% of the population not currently sure of their next meal, who will be in the tax net? Above all, the profligacy of our rulers will make tax evasion and avoidance attractive. Generally speaking, President Tinubu’s tax reform efforts are commendable but the devil is in the details- weak digital infrastructure, the tendency to use tax consultants, ethical issues and corrupt personnel embedded in the system will be the albatross.”